ASC Strategic Plan

Message from the Chair

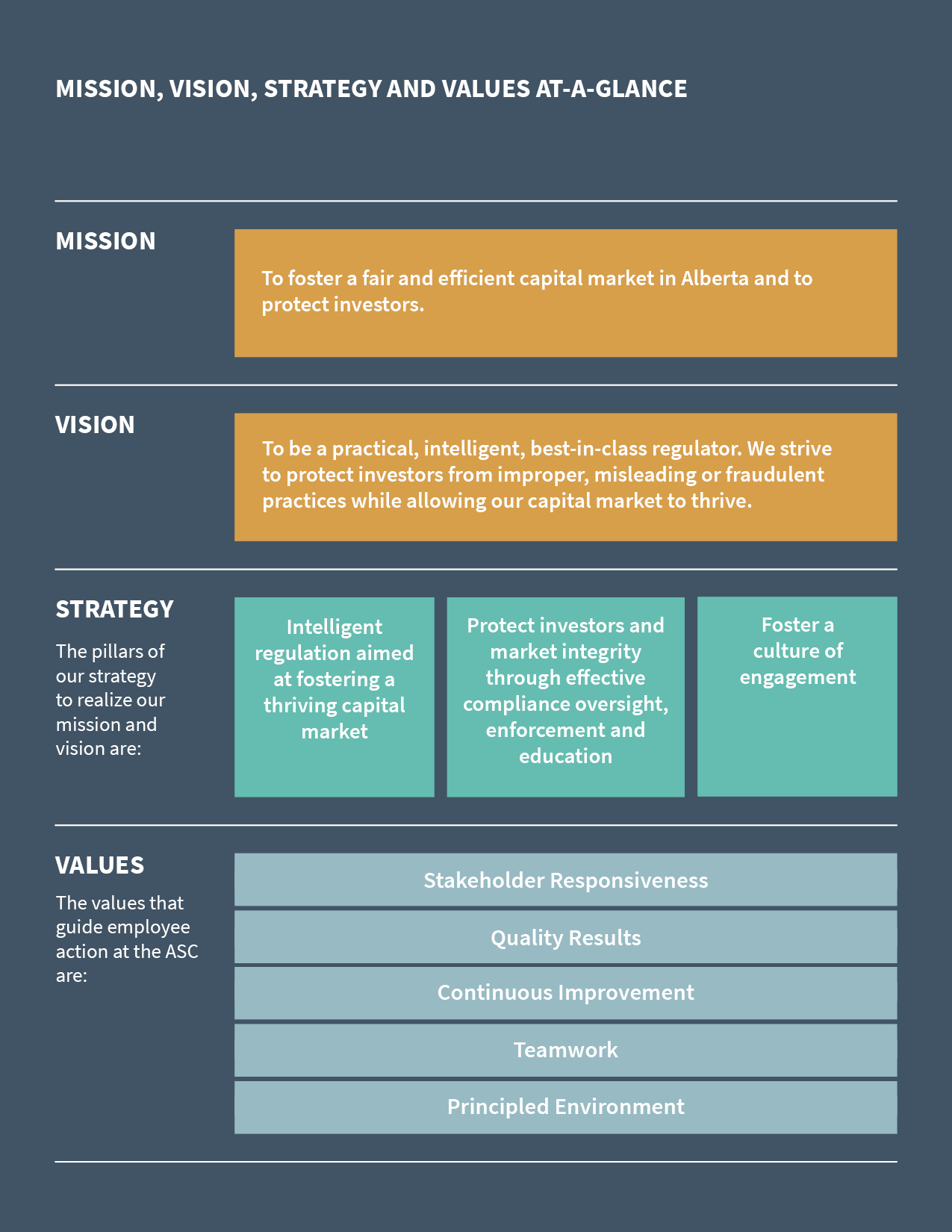

June 2023The ASC is committed to being a practical, intelligent, best-in-class regulator that strives to protect Alberta investors while enabling Alberta’s capital market to thrive. We seek to help foster conditions for economic growth and address critical market issues while avoiding undue regulatory burden on issuers and registrants.

Our capital market continues to be influenced by evolving investor priorities, environmental, social and governance (ESG) considerations, geopolitical challenges, economic uncertainty, an increased global demand for energy, especially clean energy, and more. We’re also seeing an increased number of investors gravitating towards online and do-it-yourself investing, a trend that creates the potential for uninformed decision making and increased risk of investment fraud.

The ASC monitors local and global trends, and considers possible implications for Alberta’s capital market. Through changing conditions, our aim is always to protect investors and foster a strong capital market that facilitates economic growth for Albertans. We do this by taking a thoughtful, collaborative approach to creating practical, intelligent regulation. We continue to support innovation in the capital market, and our Innovation in Finance team has been engaging with entrepreneurs, small businesses and others, to help them identify capital raising options and to work within the securities regulatory landscape.

The ASC actively collaborates with other securities regulators across Canada as a member of the Canadian Securities Administrators (CSA). We live in a large country with diverse experience, knowledge and views; and I believe our current securities regulatory structure allows us to consider all Canadian perspectives and achieve harmonized regulation across the country to serve the interests of all of our capital markets.

On January 1, 2023, a new self-regulatory organization (SRO) and a new investor protection fund were established. The new SRO, now named the Canadian Investment Regulatory Organization (CIRO), consolidated the functions of the Investment Industry Regulatory Organization of Canada (IIROC) and the Mutual Funds Dealers Association of Canada (MFDA); and the new Canadian Investor Protection Fund (CIPF) amalgamated the functions of the MFDA Investor Protection Fund and the former Canadian Investor Protection Fund. These new organizations are the result of a lot of hard work and commitment from CSA members, staff and leadership of the funds, the former MFDA and IIROC, and other industry representatives. ASC staff were integral to the process and I’m proud of the work they did to bring this to fruition. The creation of CIRO and CIPF is a positive step for industry and provides pan-Canadian regulatory continuity to protect investors, accommodate innovation and facilitate fair and efficient market operations as the investment industry evolves.

This year the ASC has also been an active participant in the collaborative and agile CSA work to monitor and strengthen our oversight of crypto trading platforms. We have done this by clarifying and expanding existing requirements for platforms operating, or intending to operate, in Canada. An increasing number of Albertans are investing in crypto assets, and we continue to encourage all investors to exercise caution and use only registered crypto trading platforms if considering investing in these inherently high-risk assets.

ESG considerations are top of mind for investors who are seeking enhanced disclosure to aid in their investment decisions, especially around climate change and diversity. The ASC is co-leading a CSA project to implement climate-related disclosure rules for Canada that are consistent and comparable with international climate- related disclosure standards and that consider Canadian issuers’ needs and capabilities. We are also co-leading a CSA project to broaden diversity disclosure beyond the reporting of women on boards and in executive officer positions, and are seeking industry feedback on the most appropriate approach for Canada. It’s important that we consider all views, as well as developments around the world, as we work to build upon our current disclosure requirements.

I believe our capital markets benefit from a variety of perspectives, and specifically we are working towards greater engagement with Indigenous Peoples. In addition to the ASC scholarships for Indigenous students pursuing a full-time Bachelor of Commerce degree we announced last year, and our work on the CSA’s Taskforce on Indigenous Peoples in the Capital Markets, we partnered with Money Moccasins, an Indigenous-led financial literacy program through Momentum, to provide financial and investment literacy to Indigenous students. Momentum works with Albertans across the province to help them fully participate in the local economy through education, action and more. This past year we supported more of Momentum’s financial empowerment programs to enhance the financial literacy of Albertans.

We recognize that we’re more effective in meeting investors’ needs by listening to what they and their advocates have to say. Their perspectives and insights are valuable contributions to our policymaking process, so I’m pleased that the CSA Investor Advisory Panel was established this past year, and that its first members were appointed in F2023. Members come from diverse backgrounds and are all highly qualified to bring the investor perspective to the table.

Investor protection is a key component of our work and we have been pursuing two important initiatives over the last year. An affordable and fair system for dispute resolution is essential, and we are continuing to work on establishing a framework that provides the Ombudsman for Banking Services and Investments (OBSI) with the authority to make awards that are binding. It is also important that investors have access to the information they need, which is why we were pleased to publish enhanced total cost reporting requirements, in collaboration with the Canadian Council of Insurance Regulators. These new requirements will help investors understand the costs they pay to invest and the value they receive in return.

In addition to the projects noted above, our staff co-led the project to adopt enhancements to the offering memorandum prospectus exemption, were instrumental in a number of burden reduction initiatives, and played an important role in preparing industry for the implementation of SEDAR+.

We’re now into our F2024–2026 strategic plan, which reaffirms our priorities to 2026. Our new plan is grounded in our experience over the last few years and was developed following extensive engagement with market participants, an environmental scan and analysis, and internal feedback from our staff. We maintained our core three pillars as they continue to serve us well, and we enhanced certain themes to provide ourselves with the flexibility to innovate and address emerging trends. An important aspect of our plan includes leveraging technology to increase efficiency, expanding the use of analytics and supporting evidence-based decision making.

The ASC’s commitment to being a responsible, professional, forward-looking regulator has never been stronger. Intelligent regulation and investor protection drive everything we do.

Please see the adjacent pages for more details of each of the strategic pillars, including a graphic representation of the key elements of our Strategic Plan.Additionally, each year we monitor and summarize our progress through our Annual Report. Stay tuned for our next Annual Report, coming in June 2024.

With kind regards,

Stan Magidson

Chair and Chief Executive Officer

Pillar One: Intelligent regulation aimed at fostering a thriving capital market

Intelligently regulating the Alberta capital market is what we do. We strive to ensure that our regulatory regime is appropriate to the needs of our market, facilitates capital growth and promotes strong investor protection while not unduly burdening issuers and other market participants.

Themes:

Reduce regulatory burden

All new laws, rules, policies and projects will be assessed to determine whether they add value, and to ensure there is due consideration of the costs of the regulation, compared to the benefits for Alberta’s unique capital market. We will also embrace opportunities to revise regulatory instruments to achieve greater clarity for the intended audience, and develop meaningful guidance and case studies to support enhanced understanding for market participants. In support of Alberta capital market innovation and development, we will monitor the use of exemptions and use a multi-divisional team to test automation and the use of technology for regulatory, supervisory and oversight purposes.

Address emerging and evolving regulatory frontiers

To keep pace with the rapidly changing Alberta marketplace and constantly evolving securities industry, we are continuing our work in a number of areas, including:

- Systemic risk: The ASC plays an important role in the CSA Standing Committee on Systemic Risk, as well as the Heads of Agencies (HoA) and its Systemic Risk Surveillance Committee. The ASC also engages with the Financial Stability Board and the International Organization of Securities Commissions (IOSCO) to actively monitor, analyze and consider how best to address risks that could impact markets nationally and internationally.

- Derivatives markets: We will continue to implement a practical derivatives framework including the necessary compliance and surveillance tools required to ensure a practical and effective regime. We will also be a leader in the CSA respecting oversight of energy commodity derivatives and monitor carbon offset markets, providing appropriate regulation.

- Environment, social and governance: The ASC will continue to play a leadership role in relevant environmental, social and governance related policy discussions, in addition to seeking appropriate regulation for our capital market.

- All things energy: We will leverage our existing oil & gas expertise and continue to build out our abilities in “all things energy” (e.g. cleantech, carbon capture, utilization and storage technology, lithium, helium and hydrogen production, and renewable energy).

- Financial technology: We will continue to monitor technological innovation in the financial marketplace and its intersection with securities laws, and develop an appropriate regulatory response. This includes conducting research to better understand “do-it-yourself” investing, gamification and the impact of social media and advancing regulatory initiatives as necessary, and addressing crypto and digital asset regulation.

- Market structure: We will continue to participate in CSA projects related to market structure.

Leverage technology

Technology plays an important role across industries, including financial services. The ASC has a digital plan to improve our use of existing technologies and incorporate new technologies to increase efficiency, expand the use of analytics and support opportunities to use evidence-based decision making.

Question the regulatory status quo

As regulators we must adapt to changing market conditions while providing a level of stability upon which market participants can depend. We will continue to work with the Canadian Securities Administrators (CSA) to be harmonized to the greatest extent possible, while still remaining a strong advocate for the unique needs of market participants in Alberta. We will also continually monitor and research alternatives, scanning both the domestic and international regulatory environments to inform our position and policies on a variety of securities matters. Projects include completing the the establishment of the new Canadian Investment Regulatory Organization and considering and revising some existing regulatory regimes.

Engage with other regulators

While our primary responsibility is to oversee the Alberta capital market, we must do so cooperatively and mindfully of regulations that govern other jurisdictions both nationally and internationally. With so many new developments, including new financial instruments such as crypto assets, securities regulation is increasingly complex and much of it occurs in an international arena. As such, we will continue to actively engage with the CSA, the HoA, the North American Securities Administrators Association (NASAA), IOSCO, and other national and international bodies, to stay informed, add value to the broader development of regulatory standards through our participation, and engage in areas that are critical to our being an effective, practical and intelligent regulator.

Support diversification of Alberta’s economy

In an effort to support the resiliency and integrity of our capital market, the ASC will continue to explore ways to support the province’s efforts to expand the financial sector in Alberta, and continue to advance the work of our multi-divisional ASC Innovation in Finance team.

Pillar Two: Protect investors and market integrity through effective compliance oversight, enforcement and education

The ASC monitors current market activity, anticipates future challenges, collaborates with other organizations and acts decisively in order to promote confidence, inform and protect investors and support market integrity.

Themes:

Detect and disrupt misconduct, and hold offenders accountable

As securities fraud and misconduct becomes ever more complex, crosses borders and incorporates new technologies to mislead investors and escape detection, it is imperative that we work collaboratively and have access to the right information, expertise, processes and technology to detect ‘bad actors’, analyze data and evidence, remove financial incentives for misconduct, disrupt securities misconduct in response to trends and minimize the threat posed by recidivists. As part of this we will also continue outreach with partner agencies to share information and collaborate, work collaboratively with other regulators and seek support of market participants to detect securities misconduct.

Ensure effective compliance oversight

Delivering effective compliance oversight is central to the ASC’s regulatory responsibilities. We will continue to make any necessary changes to ensure that we are optimally positioned to respond to the needs of our market. That includes proactively identifying emerging issues, trends, and risks in securities and derivatives market structures, as well as associated trading, dealing and advising.

Priority initiatives will include the continued operationalization of the client focused reforms and playing a meaningful role in the oversight of OBSI, including implementing binding decision making. We will also continue to refine our review process to increase personal interaction with registrants, pursue technology to assist with effective compliance oversight, monitor and analyze electronic media used in stock promotions and participate in a number of CSA working groups and projects designed to protect investors.

Enhance investor education efforts to reach a broader audience

Investment literacy is a life skill that helps investors grow and protect their hard-earned money. With longer life spans and fewer companies offering defined-benefit pensions, it is increasingly important that Canadians become knowledgeable about how to safely invest for their future.

The ASC will continue its efforts to broaden investment literacy and enhance investor protection in Alberta. We plan to continue to enhance our consumer website, CheckFirst.ca, and our social media channels, expanding tools and resources and empowering all Albertans to learn about investing. We will also actively expand our investor education outreach through partnerships and continue to conduct timely and frequent campaigns, leveraging data collected from our compliance and enforcement activities whenever possible. As part of an equity, diversity and inclusion strategy, we will plan to build and implement a plan to engage and inform Indigenous communities within Alberta.

Increase direct interaction with market constituents to more effectively communicate regulatory objectives

The ASC will continue to work with market participants to advance their understanding of the regulatory regime, including developing and providing plain language web content and sharing regular, timely and meaningful information. We will position the ASC as the regulator of choice for new market participants seeking to enter the Canadian market.

Pillar Three: Foster a culture of engagement

The collective knowledge and experience of staff at the ASC is the foundation of our success. Their efforts to build strong relationships with their colleagues and with individuals and organizations that participate in Alberta’s capital market are a critical part of the administration of provincial securities laws. We must continue to foster a strong sense of collaboration, including seeking input from market participants and encouraging a two-way flow of information.

Themes:

Engage stakeholders

Regular, timely and relevant engagement with all of our stakeholders is critical to effective administration of Alberta’s securities laws. Our priority is to enhance communications and increase two-way dialogue with stakeholders, addressing their needs and incorporating valuable feedback into future endeavours, as appropriate.

Enhance relationships with government and media

To promote efficient decision-making, alignment and timely implementation of broad policy objectives we will strive to have regular and meaningful communication between appropriate Government of Alberta officials and senior management.

In an effort to ensure our messages effectively reach and inform audiences, we continue to build relationships with media, and continually work to enhance our digital communications properties.

Staff engagement, retention, development and empowerment

We strive to ensure that employees have the right information, tools and resources to carry out their duties with proficiency, efficiency and consistency, and that projects and tasks that are pursued reflect strategic priorities. Additionally, we continue to provide a challenging and rewarding workplace that engages employees, promotes employee recognition and invests in employee growth and development.

Organizational development

By engaging with employees, we will investigate opportunities for ongoing enhancements to the organization and workplace to maximize our ability to meet strategic objectives and to achieve our vision to be a best-in-class regulator.

We are working to identify and assess technology that can improve the efficiency and effectiveness of regulatory and operational functions, while supporting hybrid collaboration and continuing to be vigilant about maintaining a high level of security for the ASC’s IT network and systems.